Laurence Smith, Financial Adviser at UEM Wealth, part of the UEM Group

BY LAURENCE SMITH, FINANCIAL ADVISER, UEM WEALTH

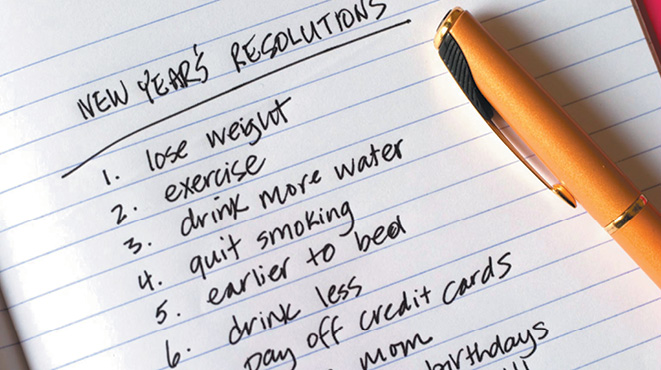

Tax planning is often viewed in a contradictory way – a last minute dash to arrange a reduction of the year’s tax bill or maximise the refund.

Tax planning is often viewed in a contradictory way – a last minute dash to arrange a reduction of the year’s tax bill or maximise the refund.

Two of the simpler ways of managing tax include:

- Deferring income until the following tax year – such as arranging a fixed deposit or other investment so that the income from the investment is paid after the end of this tax period; or

- Bringing forward expenses that won’t accrue until the next tax year by paying them this tax year, such as interest on an investment loan.

Alternatives for reducing tax are available and may result in an overall better return in the long term. Different options are available depending upon your employment status, i.e. if you are self-employed as opposed to being an employee.

Broadly speaking, some of the options include converting part of your income into superannuation contributions (salary sacrificing or making personal deductible contributions). This has the added advantage of building a valuable asset and an income for your retirement. In addition, don’t forget the tax incentive for making a contribution toward a superannuation fund in your spouse’s name.

If you are a small business owner, you could consider bringing forward the purchase of business assets. Whilst the instant asset write-off eligibility criteria and threshold have changed over time, there are currently three temporary tax depreciation incentives available to eligible businesses; temporary full expensing, increased instant asset write-off, and backing business investment.

The strategy you choose will depend upon your personal situation and needs, but one thing that’s common to everyone is the longer you leave these plans, the less benefit you receive.

If you have questions, talk to a licensed adviser and tax accountant now so you can have everything in place for June 30.

Act now and reap the rewards!

Disclaimer

General Advice Warning – this is untailored, general advice. It does not take into account your personal circumstances. You need to decide whether it meets your needs. Laurence Smith is an Authorised Representative and UEM Wealth Pty Ltd is a Corporate Authorised Representative of Lifespan Financial Planning Pty Ltd (AFSL 229892). Laurence Smith may offer services through UEM Wealth and UEM Group. Accounting services are provided by UEM Group. Financial Services (financial product advice and dealing) are provided by UEM Wealth. To the extent permitted by law, although the same adviser may offer you services under the above business, each business is solely and separately responsible for the advice they each provide.