FROM LAURENCE SMITH, FINANCIAL ADVISER, UEM WEALTH

For most Australian’s their superannuation is the largest asset that they will own in their lifetimes, second only to the family home. Home ownership (and repayment of the debt owed on that home – more on this in our upcoming article) remains one of the most common goals held by our clients. Benefits of home ownership start at security of residence and trading off rental risk for interest rate risk, flowing through to emotional attachment and a place to grow your family, right through to building of wealth as the asset appreciates in value.

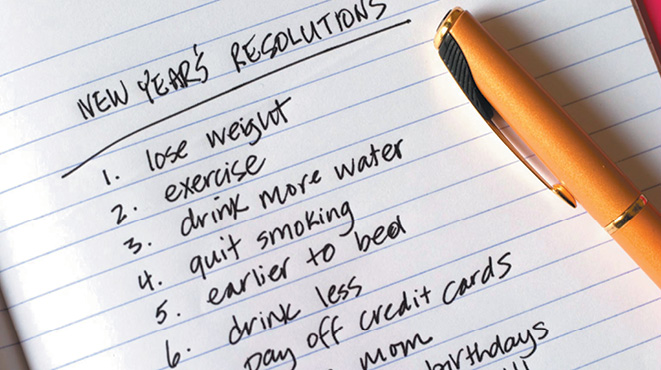

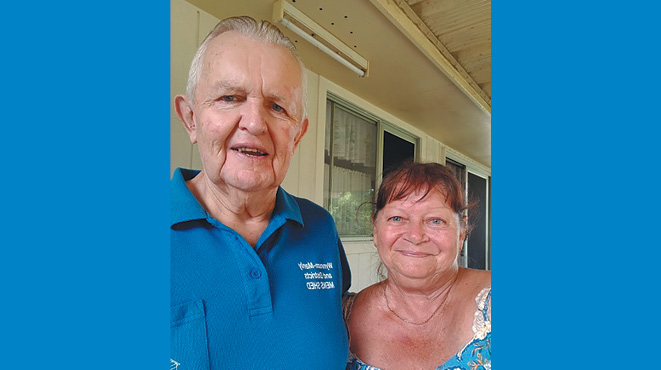

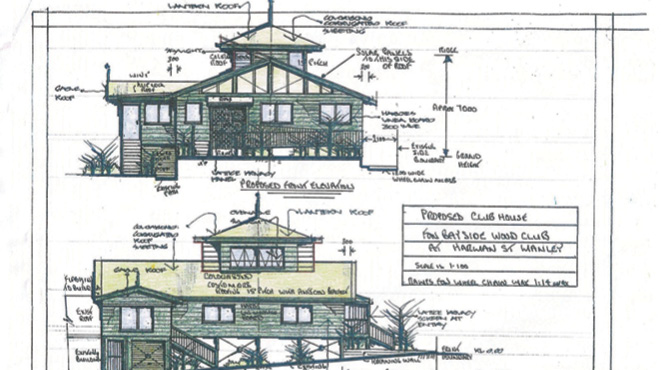

I also often field questions of the role a family home plays in retirement planning, as often once the kids have left home the property can become a collection of rooms that are empty more than they are occupied. This is where the option of downsizing starts to be considered. For example, selling a 4 bedroom family home worth $1.5 million, and using the proceeds to move to a $1 million unit or townhouse, with fewer bedrooms, better security, or more comfortable living.

There is a special kind of superannuation contribution that you may benefit from in this instance, provided that all relevant criteria are met. This is called the “Downsizer Contribution”.

The eligibility criteria are publicly available on the ATO web site¹:

- You are aged 55 years or older.

- Your home was owned by you, or your spouse, for 10 years or more prior to sale.

- Your home is in Australia, and is not a caravan, houseboat, or other mobile home.

- The proceeds are either exempt or partially exempt from capital gains tax (CGT) under the main residence exemption.

- You make your contribution within 90 days of receiving the proceeds of sale.

- You have not previously made a downsizer contribution to your super from the sale of another home.

- You provide the appropriate form to your superannuation fund either before or at the time of making your contribution.

The benefits of this kind of contribution are that it will not count towards your regular contribution caps, and has no maximimum age limit under the eligibility tests. It is one of the only ways to replenish a superannuation balance when the account holder is older than age 75 (after which personal contributions to superannuation are no longer possible).

Using this rule in combination with other contribution caps can facilitate a larger than ordinary contribution to superannuation also. Consider if a couple decided to exercise this rule, but did so between the ages of 55 and 75. It would be possible for each individual to contribute up to $660,000 to their superannuation funds, meaning a whopping $1,320,000 of contribution made in a single year². You may also be able to use this as an opportunity to restructure the tax components of a superannuation fund to make it more tax efficient as an estate planning vehicle.

The best time to engage a financial planner to explore whether this strategy woud be useful is before a home is listed for sale. This way, you can ensure that you understand their eligibility criteria and the full scope of advantages that this strategy can make to your future retirement.

- https://www.ato.gov.au/individuals-and-families/super-for-individuals-and-families/super/growing-and-keeping-track-of-your-super/how-to-save-more-in-your-super/downsizer-super-contributions

- This strategy would utilise a downsizer contribution and full bring forward rule regarding their personal non-concessional contributions. Further criteria would need to be met to execute this, including review of the individual’s total superannuation balance cap and historical contributions.

DISCLAIMER General Advice Warning – this is untailored, general advice. It does not take into account your personal circumstances. You need to decide whether it meets your needs. Laurence Smith is an Authorised Representative and UEM Wealth Pty Ltd is a Corporate Authorised Representative of Lifespan Financial Planning Pty Ltd (AFSL 229892). Laurence Smith may offer services through UEM Wealth and UEM Group. Accounting services are provided by UEM Group. Financial Services (financial product advice and dealing) are provided by UEM Wealth. To the extent permitted by law, although the same adviser may offer you services under the above business, each business is solely and separately responsible for the advice they each provide.