FROM LAURENCE SMITH, FINANCIAL ADVISER, UEM WEALTH

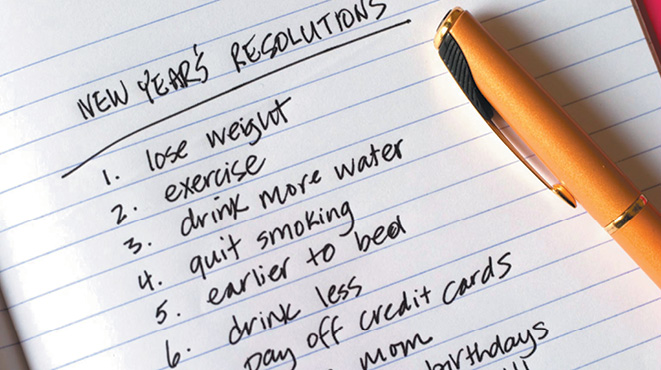

The 30th of June is fast approaching, meaning it’s that time of year again to think about making the most of the current financial year arrangements. Here is a quick (non-exhaustive) list of items to think about and action where appropriate before the financial year closes out.

Superannuation contributions

Individuals have an annual cap of $30,000 for concessional contributions to superannuation. The contributions that count towards this cap are the superannuation guarantee from employers, salary sacrificed (pre-tax) contributions, and personal contributions that are to be tax deducted. They are known as “concessional contributions” because these superannuation contributions are only taxed at 15%, which is often less than an individual’s marginal rate of tax. If you’re eligible, and if you have unused caps from previous five years, the Australian government allows you to catch up on your super contributions by adding in more than the annual limit.

Because the cap is calculated per financial year, it may be worthwhile to check how much you have already contributed, to decide whether any last minute contributions would be useful to grow super and control tax. This could also be useful if a capital gain was realised during the year, as a gain could increase your taxable income, resulting in a higher calculated tax obligation.

The second way to contribute to super is through a non-concessional contribution. The annual cap for this type of contribution is $120,000 per annum, and these are contributions that cannot be used to directly modify taxable income (that is, through claiming a tax deduction). If certain requirements are met, you may be able to use the three-year bring forward rule and contribute more in a single year. Most often the benefit that arises from this type of contribution is to shift funds available for investment into superannuation, which is a low tax investment environment for many people, to boost retirement savings.

Low and middle income earners making a non-concessional contribution may be eligible to receive a government co-contribution of up to $500. Another specific benefit can be gleaned from making a contribution to a low-income earning spouse’s superannuation account. Spouse contributions count towards the receiving spouse’s contribution cap, but can enable the contributor to claim a tax offset of 18% of the amount contributed (up to $540). Income limits apply to both of these strategies, so check the finer details before moving ahead.

Deductible expenses

Tax deductions reduce taxable income before the applicable tax is calculated. For example, someone earning $80,000 (sitting in the 30% marginal tax bracket), may pay $1,000 for a work related subscription. Claiming this as a tax deduction reduces that individual’s taxable income to $79,000 and therefore reduces the tax calculated by $300 (or $30% of the $1,000). If these expenses are incurred in June, rather than July, then the reduced taxation can be recorded in the current year’s tax return, meaning a larger tax refund received sooner.1

Asset Sales

The tax implications resulting from asset sales can depend heavily on the timing of the sale. The best laid plans can come undone by not considering the correct date associated with a sale. For example, an individual selling an investment property may plan on making a tax deductible superannuation contribution from the proceeds of the sale, which may also reduce the tax payable in that financial year. It’s important to consider however, that the contract date will determine when the sale is taxed (not the settlement date).

Taxation and superannuation are two fairly complicated and interrelated areas that require professional advice to navigate. Certain requirements apply to each of above listed strategies. Penalties can be applied for non-compliance. If you’re unsure of what combination of strategies may be best for you, please seek advice from an accountant or a professional financial adviser.

1 If your income and concessional contributions exceed $250,000 in 2024/25, you may have to pay an additional 15% tax on some or all of your concessional contributions.

DISCLAIMER General Advice Warning – this is untailored, general advice. It does not take into account your personal circumstances. You need to decide whether it meets your needs. Laurence Smith is an Authorised Representative and UEM Wealth Pty Ltd is a Corporate Authorised Representative of Lifespan Financial Planning Pty Ltd (AFSL 229892). Laurence Smith may offer services through UEM Wealth and UEM Group. Accounting services are provided by UEM Group. Financial Services (financial product advice and dealing) are provided by UEM Wealth. To the extent permitted by law, although the same adviser may offer you services under the above business, each business is solely and separately responsible for the advice they each provide.