BY LAURENCE SMITH, FINANCIAL ADVISER, UEM WEALTH, AUTHORISED REPRESENTATIVE, LIFESPAN FINANCIAL PLANNING PTY LTD AFSL 229892

What happened to 2025? It feels like Australia Day was last week, and now it’s time to prepare for Michael Bublé and Mariah Carey to be played in shopping centres again.

And it is expected to be the most wonderful time of year again, particularly by retailers. The Deloitte 2025 Retail Holiday Report suggests that 84% of retailers expect sales to grow compared to last year, and a survey of consumers in the same report suggests that 76% of respondents expect to spend at least the same amount or more than they did last year1.

Here are my top five ideas for gift giving that will not leave you with January credit card regret.

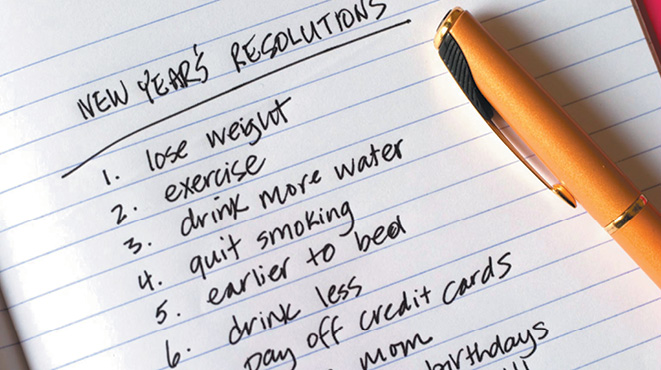

1. Make a list

The best place to start is to consider who you will be buying gifts for. Start from your inner circle and work your way out. Depending on your budget, you can decide which people make it to your list and start thinking about who is higher or lower on your list. This leads to the next step.

2. Create a budget

Maybe you’ve been diligently saving some cash aside throughout the year, specifically for Christmas gifts, or maybe you have a more general savings strategy. Either way, one of the best ways to make sure you don’t overspend is to consider realistically what resources you have. Having a credit card limit that you plan to carry into the new year and pay off over a few months doesn’t count. Try to avoid this if you can.

3. Choose meaningful gifts

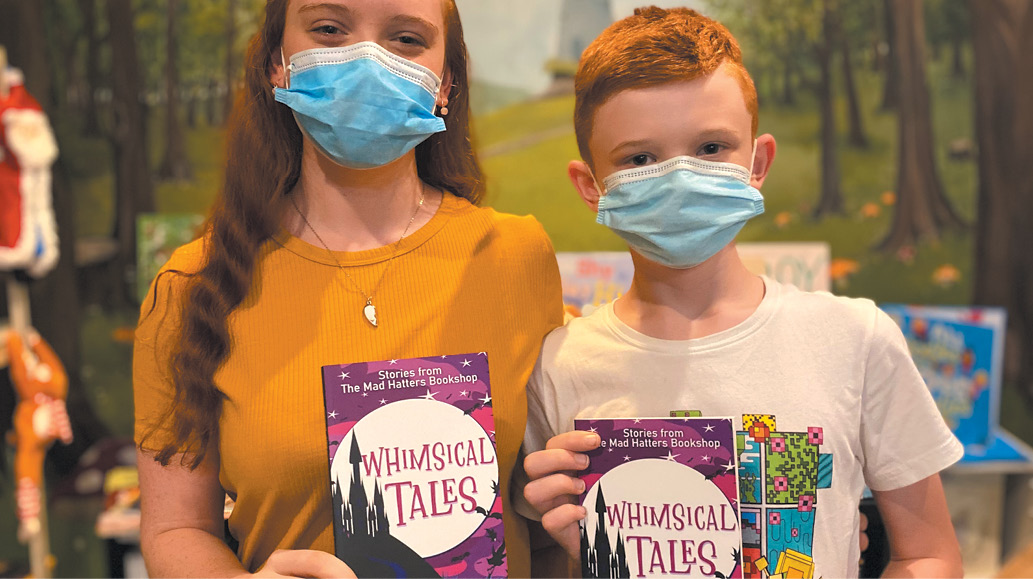

Rather than hitting the shops with a vague idea of what you need to buy and looking for inspiration while at the shops, sit for an evening and think about the person you are buying for. When giving a gift to a family member or a friend, consider what their interests and hobbies are and narrow down your selection to what you feel they may truly appreciate. For children, there is a formula that can help: Something they want, something they need, something to wear, something to read.

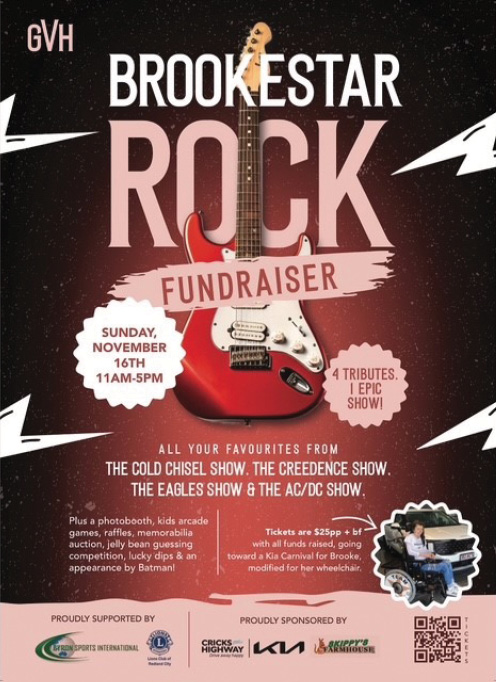

4. Give your time

One of the most memorable and enjoyable gifts that I remember ever giving was a voucher to my grandmother for a lunch date with me. She was so happy to receive it, and it created a wonderful memory that I still get to recall on occasion. Plus, Sizzler toast was irreplaceable. Sometimes the best gift you can give can’t be bought and wrapped, and it’s definitely worth considering.

5. Plan ahead for next year

If Christmas this year comes up before you know it, then get ahead of it by starting in January. An ASIC article from 2024 suggested that, on average, Aussies planned on spending $783 on Christmas.2

Short-term savings interest aside, starting in January and saving $20 each week will allow you to stash $860 aside by November 2026. That may cover a portion of your spending for next year and is easily done through most bank providers.

I’d also suggest keeping your list of gift recipients from step 1 and reviewing it every month or so to jot down some gift ideas. Planning ahead may even allow you to take advantage of sales that occur throughout the year.

It’s not rocket science when you get down to it, but a few small, good habits will make a massive difference to the holiday season.

1 (https://www.deloitte.com/content/dam/assets-zone1/au/en/docs/industries/csm_Retail%20Holiday%20Report-2025.pdf

2 (https://www.asic.gov.au/about-asic/news-centre/find-a-media-release/2024-releases/24-272mr-asic-s-moneysmart-reveals-how-aussies-plan-to-spend-this-christmas/)

DISCLAIMER General Advice Warning – this is untailored, general advice. It does not take into account your personal circumstances. You need to decide whether it meets your needs. Laurence Smith is an Authorised Representative and UEM Wealth Pty Ltd is a Corporate Authorised Representative of Lifespan Financial Planning Pty Ltd (AFSL 229892). Laurence Smith may offer services through UEM Wealth and UEM Group. Accounting services are provided by UEM Group. Financial Services (financial product advice and dealing) are provided by UEM Wealth. To the extent permitted by law, although the same adviser may offer you services under the above business, each business is solely and separately responsible for the advice they each provide.