BY LAURENCE SMITH, FINANCIAL ADVISER, UEM WEALTH, AUTHORISED REPRESENTATIVE, LIFESPAN FINANCIAL PLANNING PTY LTD AFSL 229892

There are four types of personal insurance available in the Australian market. Three of these are broadly discussed and more well-known, and the final one is less so.

Let’s start with familiar territory. Life, Total and Permanent Disability (TPD), and Income Protection cover are broadly covered and discussed in the news and through superannuation fund education seminars. They are all very important and play a vital role in any financial plan. One of the reasons that these insurances have had more exposure to consumers is their broad distribution through superannuation products.

Because large superannuation funds can purchase a policy that can cover all their members (also called “Group Cover Insurance” if you want to Google for more information), Life, TPD, and basic income protection are often offered to members by their super fund. And rightly so too – these covers provide benefits to nominated beneficiaries when a person passes away or can assist in managing the long-term costs of an illness or injury that forces someone to stop working.

But what about if an illness or injury is serious, but not serious enough that the insurer determines a benefit is payable? TPD and Income Protection insurance both rely on a definition of “disability” being met. If cover is held through superannuation, the definition is broader and slightly more difficult to meet. The insured person must also contend with the tax implications of accessing a benefit from the insurer.

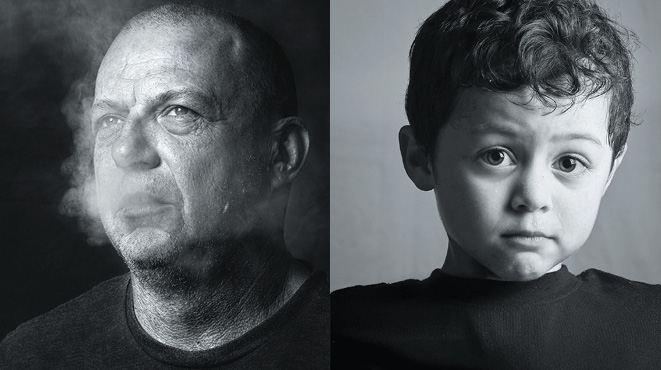

Trauma insurance provides the final missing piece to a comprehensive insurance plan. Trauma insurance policies (also commonly referred to as “Critical Illness” insurance) also rely on a definition being met for a payment to be completed; however, they are not based on a subjective condition of whether an insured person is able to work. They are instead based on the medical diagnosis of the condition.

All policies will list the conditions that are covered and will generally cover heart conditions (including heart attacks or surgery on the heart), cancers, organ diseases, neurological diseases, and burns or traumatic events, and normally a range of others. The insured benefit of this kind of insurance is not like that of private health insurance. The policy has a dollar amount of benefit, which is normally paid as a tax-free lump sum.

The benefit of the policy is that the payment can be used for any purpose that is needed. It can be used to pay for medical treatments, taxi or Uber fares, groceries, bills, or to maintain mortgage repayments. The difference between trauma insurance and private health insurance is that a private health insurance policy will cover some treatments and the cost of a hospital admission. It will not cover any of the ancillary or extra costs associated with a serious illness, like transport, lost earnings, or just keeping life going. In many instances, it is not only the individual who has had the trauma who is impacted, as often family members step in to help care for the individual.

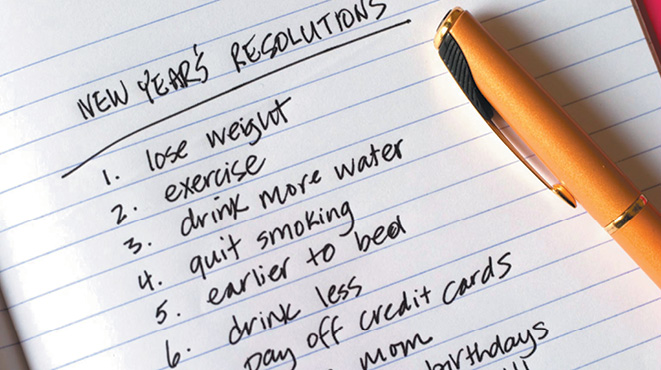

Like most insurances, it has a cost. There needs to be a commitment of the policy holder to purchase and maintain the policy, and the costs may increase each year. But, like with most insurances, the decision comes down to what will cost more: having the policy or not having it when it is truly needed.

DISCLAIMER General Advice Warning – this is untailored, general advice. It does not take into account your personal circumstances. You need to decide whether it meets your needs. Laurence Smith is an Authorised Representative and UEM Wealth Pty Ltd is a Corporate Authorised Representative of Lifespan Financial Planning Pty Ltd (AFSL 229892). Laurence Smith may offer services through UEM Wealth and UEM Group. Accounting services are provided by UEM Group. Financial Services (financial product advice and dealing) are provided by UEM Wealth. To the extent permitted by law, although the same adviser may offer you services under the above business, each business is solely and separately responsible for the advice they each provide.