BY LAURENCE SMITH, FINANCIAL ADVISER, UEM WEALTH, AUTHORISED REPRESENTATIVE, LIFESPAN FINANCIAL PLANNING PTY LTD AFSL 229892

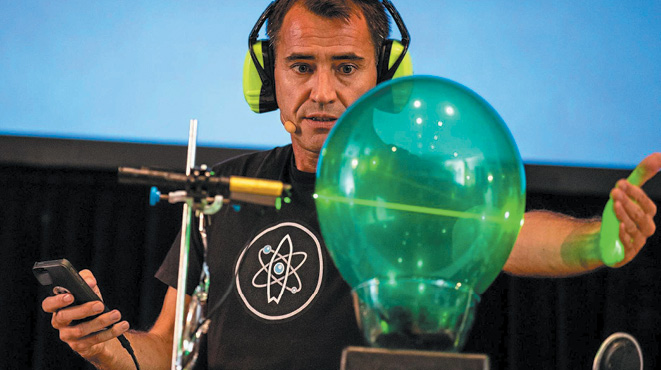

Smartphones and high-speed internet have transformed the way we live, making almost every service available at the push of a button or a scan of a QR Code. From ordering a meal at a pub to booking Uber Eats and streaming a Friday night movie at home (does anyone remember Blockbuster?), digital applications allow services to be delivered to us rather than us needing to go to the service.

Smartphones and high-speed internet have transformed the way we live, making almost every service available at the push of a button or a scan of a QR Code. From ordering a meal at a pub to booking Uber Eats and streaming a Friday night movie at home (does anyone remember Blockbuster?), digital applications allow services to be delivered to us rather than us needing to go to the service.

But convenience doesn’t stop at food and entertainment. Domestic services like lawn mowing, garden maintenance, home cleaning, and even pool care are just a few taps away. When my car battery failed last month, even RACQ directed me to complete an online form to book roadside assistance. It was amazing, and I would say it was even faster than calling a call centre.

This convenience comes with a price tag. The question is: what’s the real cost? Beyond the cost of the service being delivered, there is normally a small charge or fee that is attached to each transaction. Take a close look next time you order a meal directly from your table; you will probably see a couple of dollars added to the bill.

These surcharges and service fees can add up quickly, particularly if orders are placed across several transactions. It’s worth asking whether the time saved is truly worth the expense. For example, if you’re time-poor and value your weekends, paying a cleaner for a few hours might be a smart investment. On the other hand, spending an extra $6 to avoid walking a few hundred metres for a chicken schnitzel might not be.

There’s also a bigger picture to consider – life lessons for kids. Outsourcing every chore means fewer opportunities for them to learn responsibility. A sure way to not appreciate the magical age we live in is to normalise it. After all, some parents joke that one of the best reasons to have kids is to get help mowing the lawn.

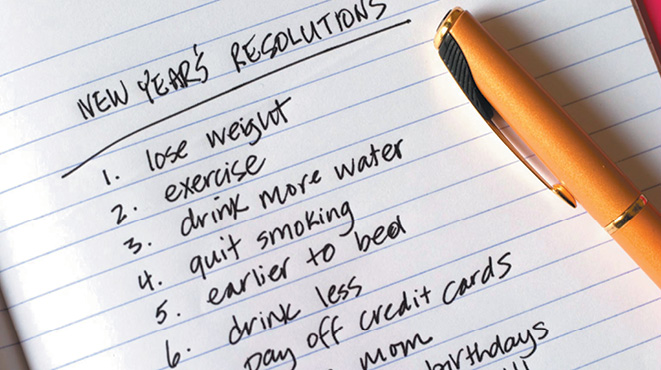

The takeaway? Don’t avoid convenience, but don’t ignore its impact either. Use money as a tool to enhance your life, not as a shortcut for every minor inconvenience. If you want to become more aware of surcharges and extra service spending, track it for a month and consider what else that money could be used for. Take up the ultimate money-hack for 2026, and take charge of what money is being spent on. Take a Marie Kondo approach – if it doesn’t add value, it’s not worth it.

And if you need help to set some financial priorities, a financial planner is uniquely positioned as an impartial third party to help you set some ambitious goals achievable goals for the year.

DISCLAIMER General Advice Warning – this is untailored, general advice. It does not take into account your personal circumstances. You need to decide whether it meets your needs. Laurence Smith is an Authorised Representative and UEM Wealth Pty Ltd is a Corporate Authorised Representative of Lifespan Financial Planning Pty Ltd (AFSL 229892). Laurence Smith may offer services through UEM Wealth and UEM Group. Accounting services are provided by UEM Group. Financial Services (financial product advice and dealing) are provided by UEM Wealth. To the extent permitted by law, although the same adviser may offer you services under the above business, each business is solely and separately responsible for the advice they each provide.