BY LAURENCE SMITH, FINANCIAL ADVISER, UEM WEALTH, AUTHORISED REPRESENTATIVE, LIFESPAN FINANCIAL PLANNING PTY LTD AFSL 229892

As a professional financial planner, I get to hear all kinds of ideas and strategies for building wealth. One of the amazing things about seeing a financial planner is being able to receive objective outside feedback. I’m not here to bolster my client’s feelings. In fact, one of the primary obligations I have is to be frank and fair to each of my clients. This means that if a client has a bad investment idea, it’s part of my role to talk through why.

Don’t get me wrong – a lot of the time, if someone has thought through a strategy fully, they come to me with a great understanding. Unfortunately, being too close to something can give rise to bias that pushes people towards a conclusion without thinking about the potential for things to go wrong. When it comes to wealth creation strategies, something that sounds too good to be true generally will be.

Complicated schemes promising unbelievable success with very little chance of downside risk inspire two feelings for me: 1. The strategy is not truly understood. Or 2. Something is being sold. After seeing loads of schemes, strategies, and ideas along the way, I’ve come to the conclusion that when it comes to building personal wealth, it’s best to keep things as simple as possible and only as complicated as they need to be.

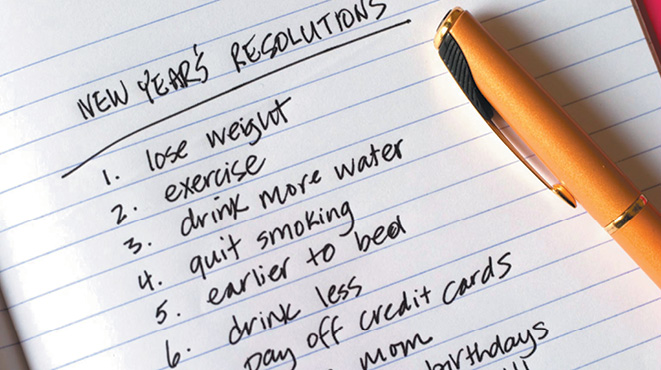

Here are some actionable ideas to keep things simple but still build wealth:

Control spending – Household finances need a system to be sustainable. This starts with income earned, followed by setting priorities on how to allocate the income, and finishes with a surplus to be applied to other goals. If habit and impulse creep in, it can push spending above income. This is called a cash flow deficit. It’s bad. First of all, it means that there’s no money left to put towards growing wealth, and secondly, it needs to be funded from somewhere – either longer-term investments or (even worse) from debt.

Allocate the surplus – Once spending is under control, think about the best place to allocate the surplus depending on your personal goals, priorities, and preferences. A quick run through of potential targets could be: 1. Emergency Fund (at least 3 x months of core expenses); 2. Extra debt repayments; 3. A personal investment plan; 4. Superannuation or other long-term savings.

If you can keep it simple, then do – Before adding extra complication to your system, ask the obvious question: “Will this make a difference, and is that difference worth it?” Extra bells, cogs, whistles, and gears may make a difference to the outcome of a financial strategy, but will that difference be worth it? Will it be worth the additional risk of something going wrong, the additional time and strain that it takes to keep the system running, and what would be the comparative result if things were kept simpler? If you can’t run the more complicated system yourself, how much will it cost to hire assistance from an accountant, financial planner, or real estate agent?

Don’t start without considering the finish – The best chess players in the world don’t blunder blindly into strategies. They plan at the opening, monitor and modify through the mid-game, and keep an eye on the end-game. Wealth strategies are the same. Before diving into a new scheme promising riches, think through an exit strategy. Ideally, think through a number of different outcomes: One for if things happen perfectly as planned, one for an average outcome (is it still worthwhile), and one for if something goes wrong.

Building wealth isn’t difficult, but it’s not simple either. Ultimately, anyone can do it, and if you need help, it is readily available.

DISCLAIMER General Advice Warning – this is untailored, general advice. It does not take into account your personal circumstances. You need to decide whether it meets your needs. Laurence Smith is an Authorised Representative and UEM Wealth Pty Ltd is a Corporate Authorised Representative of Lifespan Financial Planning Pty Ltd (AFSL 229892). Laurence Smith may offer services through UEM Wealth and UEM Group. Accounting services are provided by UEM Group. Financial Services (financial product advice and dealing) are provided by UEM Wealth. To the extent permitted by law, although the same adviser may offer you services under the above business, each business is solely and separately responsible for the advice they each provide.